Grow your revenue with the power of customisation

Brokerage

100% sharing

beyond ₹2/order

100% Control

Choose your business model:

- Discount

- Traditional

- Hybrid (Discount + Traditional)

Pay Later (MTF)

100% sharing over base rate

Up to 10% sharing on base ratePledge Shares

100% sharing over base rate

5% sharing on base rate

आपके बड़े सपनों को उड़ान दें, Mirae Asset के साथ

Our Partner program offers unbelievable pricing, a seamless tech platform for an enhanced experience for you and your clients. It also gives you full control and ownership, reducing dependency on us. 100% payout up to ₹1 lakh per month, beyond ₹1 lakh 20% will be retained by Mirae Asset. For detailed payout terms, click here

the payout opportunities with examples

- Clients

300 - Brokerage per client

₹12,000 - Total Brokerage

₹36,00,000

- MTF clients

100 - MTF book

₹3 Crore - Interest rate

15% p.a.

- Margin pledge clients

100 - Margin book

₹2 Crore - Interest rate

18% p.a.

- No. of Scripts per day

25 - Charges

₹18 - ₹28 - Annually Charges

₹1,08,000 - ₹1,68,000

- MF active clients

100 - Average AUM

₹10 Crore - Average trail income

1%

Account Opening FeeOpportunity to charge up to ₹9,999

Account Operating Charges Charge up to ₹4,999

Pledge, unpledge charges (MTF, Pledge Shares)Earn 20%

The 'Mirae Asset' advantage

Experience India's first 100% Digital Partnership program, designed to transform your business like never before.

1 Partner with a Global Trusted Brand

26 years+ of expertise, trusted across 12 countries and 22 lakh+ clients

2 Experience how digital partnership business can change your world

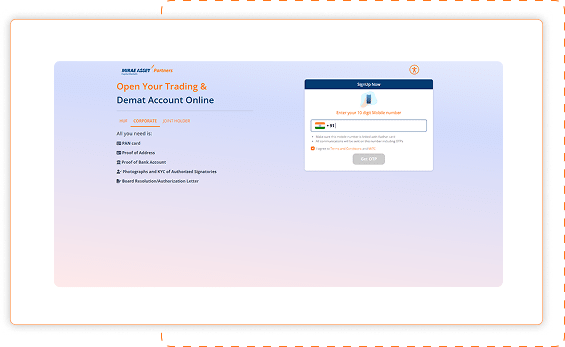

- Onboard non-individual account 100% digitally

- Create your business model: Discount, Traditional or Hybrid

- 100% flexibility in customising client's pricing plan

- Earn form 9 revenue streams

- Track your payouts with product & client wise breakup

- Support your client's trading activities with CTCL terminal

- Create Branch & manage Relationship Manager (RM) access through the dashboard.

3 Onboard clients & track status in minutes

Do it for your clienton their behalf and share link with them only for documentation

Share joining linkwith your clients and let them do it themselves

Upload list for bulk onboardingand get multiple clients onboarded in one go

4 All-in-one integrated dashboard

Access to client-wise trading positions, revenue, payouts & back-office reports

5 Grow Your Business with Mutual Funds

Offer diverse funds & boost revenue with easy client access and tracking

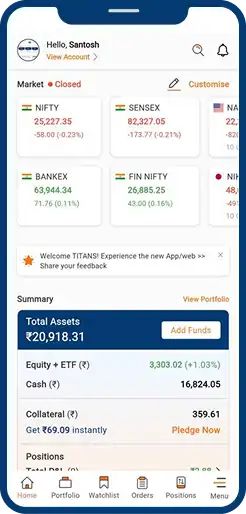

What's in it for your clients?

- 1Assurance of brand Mirae Asset

- 21-click order placements – Smart Order, Watchlist PRO

- 3Multi-channel access through Web & App

- 4Options Strategy Builder with 30+ pre-defined strategies

- 5Place real time trades directly from TradingView charts

- 6Smart & easy to understand ledger and reports

- 7Curated Expert Research & Advice

- 8Get instant margin against pledge to buy & sell options

- 9Fast Trading APIs

- 10Multi-account login

- 11Range of products like Equity, IPOs, advisory-based portfolios & more

In just 3 years...

- Earned trust of

22 Lakh+ customers - Facilitated

₹98 Crore+ trades - Built MTF book of

₹1,263 Crore+

Frequently Asked Questions

1. Who is an Authorised Person?

Authorised persons (formerly known as sub-brokers) provide access to trading platforms and assistance for investments between stockbrokers and clients. The APs are registered with the NSE and BSE and they work as agents of stockbroking houses to create an advanced business network for them.

An AP can be an individual, partnership firm, LLP, or a corporate entity.

2. What is the role of an Authorised Person?

3. Who can be appointed as an Authorised Person?

Individual: A resident of India, above 18 years of age.

Partnership firm: A firm that is registered under Indian Partnership Act, 1932.

LLP: A firm that is registered under the Indian Limited Liability Partnership Act, 2008.

Corporate: A firm that is registered under the Indian Companies Act, 1956.

4. Can Hindu Undivided Family (HUF) be appointed as an Authorised Person(AP)?

5. What are the documents required to register as an Authorised Person?

To register as an individual Authorised Person, you need to have the following documents:

- PAN Card

- Residential Address proof of the individual

- Registered Office Address proof of the Applicant (if business address given)

- Educational Qualification (minimum 10th (SSC) marksheet/passing certificate)

- Bank Account Details- where the monthly payouts will be released.

- Note: All documents should be in the name of the applicant

- Note: Name change affidavit needed in case of name mismatch.

To register as a Corporate Authorised Person, you need to have the following documents:

Corporate Documents

- Company Pan

- Company Address Proof

- Incorporation Certificate

- Copy of MOA & AOA

- BSE/NSE Annexures certified by C.A

- Authorised signature letter (Signed by all Directors)

- Board Resolution

- Company Bank Proof

- List of Directors certified by C.A

Directors Documents

- Pan Card of all Directors

- Address proof of all Directors

- Education proof All Directors

- Marriage Certificate (If Applicable)

Memorandum of Association (MOA), including the certificate of incorporation of the corporate applicant:

- The main object clause should include a clause permitting the corporate firm applicant to deal in shares and securities business

- If the above-mentioned clause does not exist in the main objects clause of the MOA, a certified true copy of the board resolution approving the inclusion of the said clause in the main objects clause of the MOA must be submitted

- The following Annexures should be downloaded and get attested by CA and uploaded in the given link.

- NSE Annexure 3 - Details of directors of the AP.

- NSE Annexure 4 - Details of shareholding.

- BSE Annexure 2 (b) (v)

To register as a Partnership/LLP Authorised Person, you need to have the following documents:

Partnership/LLP Documents:

- Partnership/LLP Pan

- Partnership/LLP Address Proof

- Registered ROF Certificate

- Partnership/LLP deed

- Authorised signature letter

- Partnership/LLP Bank Proof

Partner Documents:

- Pan Card of All Partners

- Address proof of All Partners

- Education proof All Partners

- Marriage Certificate (If Applicable)

For Partnership deed, please note the following pointers

- Registered Partnership Deed / LLP Agreement should consist of clause/nature of business permitting the applicant firm to deal in shares and securities

- In case of main clause is added of dealing in shares and securities following documents should also be needed. 1) Supplementary deep 2) MCA receipt copy of acknowledgement

- The following Annexures should be downloaded and attested by CA and uploaded in the given link.

- NSE Annexure 3 LLP

- BSE Annexure 2(b)(v)